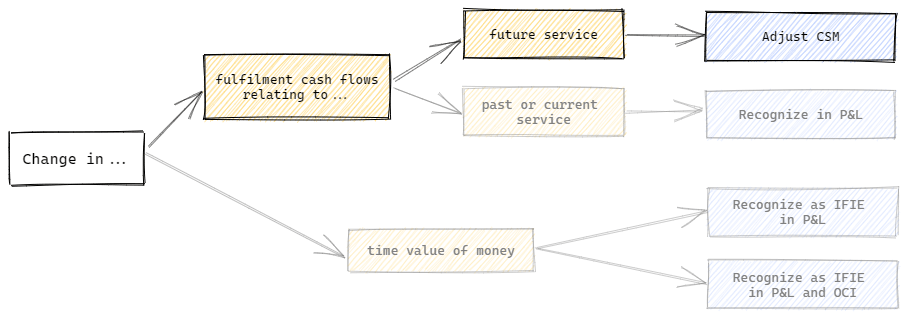

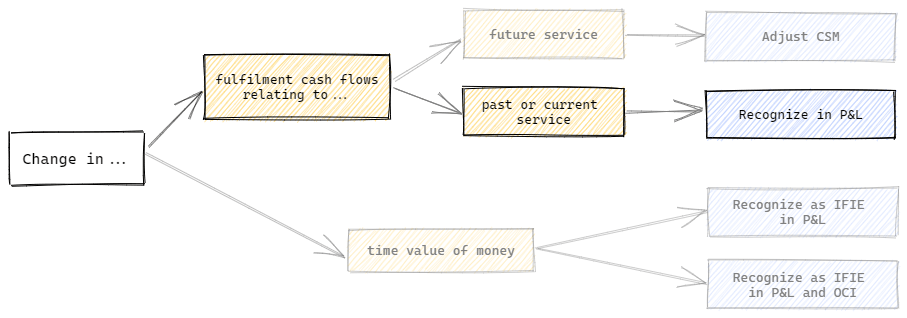

In this post, let's analyze the change in fulfilment cash flows over time and how these changes are reflected in the measurement of the insurance contract.

IFRS 17 specifies different treatments for changes in fulfilment cash flows, depending on whether the change relates to future service or past and current service. Changes in fulfilment cash flows due to unwinding of the discounting are presented as net insurance finance expense.

So, we have three cases:

- changes in fulfilment cash flows that relate to future service,

- changes in fulfilment cash flows that relate to past or current service,

- changes in the time value of money or financial risk.

Let's take a look at each of these cases a little bit closer.

Changes relating to future service

The first type of change is the change in fulfilment cash flows that relates to future service. An example of this change are developments that might make future claims more or less frequent or expensive.

Example: New IT system reduces administrative costs over the remainder of policy.

Action: Adjust the CSM

Changes relating to past or current service

The second type of change is the change in fulfilment cash flows relating to past or current service. An example of such change is the decrease in the risk adjustment due to expired risk or experience variances that relate to claims in the current period.

Example: One-off price reductions of the equipment make individual claims in the current year cheaper than expected.

Action: Recognize in the stament of profit or loss.

Changes in the time value of money or financial risk

The third type of change is the change in the time value of money or financial risk.

Example: Reduction of discount rates.

Action: The impact should be recognized as IFIE. An insurer can choose to present it in P&L or disaggregate between P&L and OCI.

(2024-01-31)

Very clearly stated, thank you