In this post, let's take a look at the initial and subsequent accounting for the Contractual Service Margin (CSM). We will focus on products without direct participating features.

Initial recognition

Let's take an example of a contract with a 3-year coverage period without any investment component.

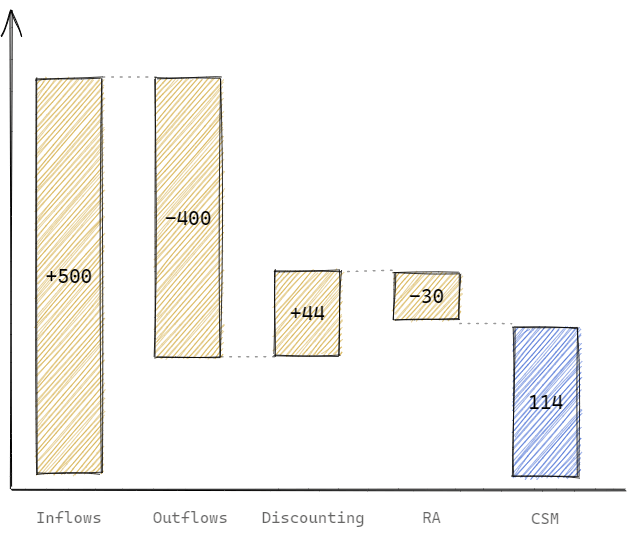

The policyholder pays a premium of €500 at initial recognition. The expected claims and expenses amount to €400 at the end of the third year of coverage. For simplicity, there is no surrender option and no expected lapses.

The discount rate at initial recognition is 3%. The present value of the expected claims and expenses is €366. The risk adjustment has been estimated to be €29.

The CSM amounts to €105.

Subsequent Measurement

Let's go through how we measure the CSM from one reporting period to the next.

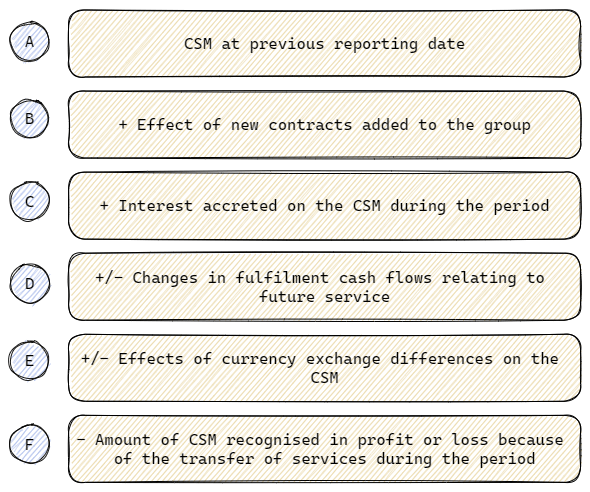

- We start with the CSM from the previous reporting date.

- The CSM increases if new profitable contracts are added to the group.

- Interest is added to the CSM adjusted for the new contracts at the locked-in rate.

- The CSM is adjusted for changes in the fulfilment cash flows that relate to future service.

- The CSM of contracts written in a different currency to the insurer's currency is affected by changes in exchange rates.

- Part of the CSM balance at the end of the period is released to profit or loss. This amount corresponds to the delivery of services over the reporting period.

Changes after the first year

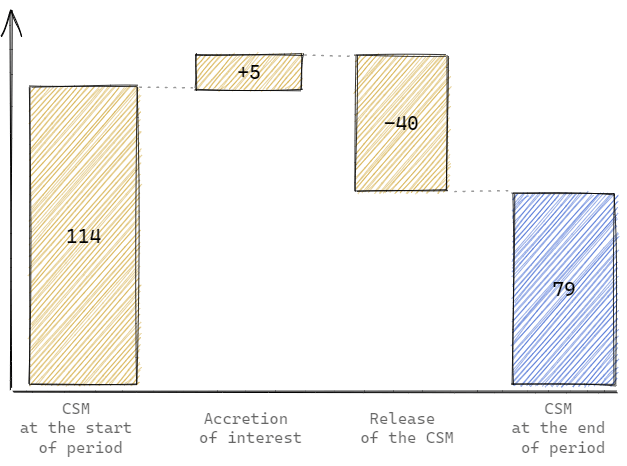

For simplicity, let's assume that there are no new contracts and no impact of exchange rates. If everything goes as expected, then we see only two movements in the CSM: the accretion of interest and the CSM release. These two movements always occur.

For the accretion of interest, we use the rate from the initial recognition, i.e. 3%. That gives us the increase of €3.

The second is the CSM release. The recognition of CSM in P&L is determined by allocating the balance of the CSM to coverage units. Since we provide the same service each year, we can release approximately the same amount of CSM. After the first year, we will release 1/3 of the CSM, i.e. (€105 + €3) * 1/3 = €36.

Changes over the full coverage period

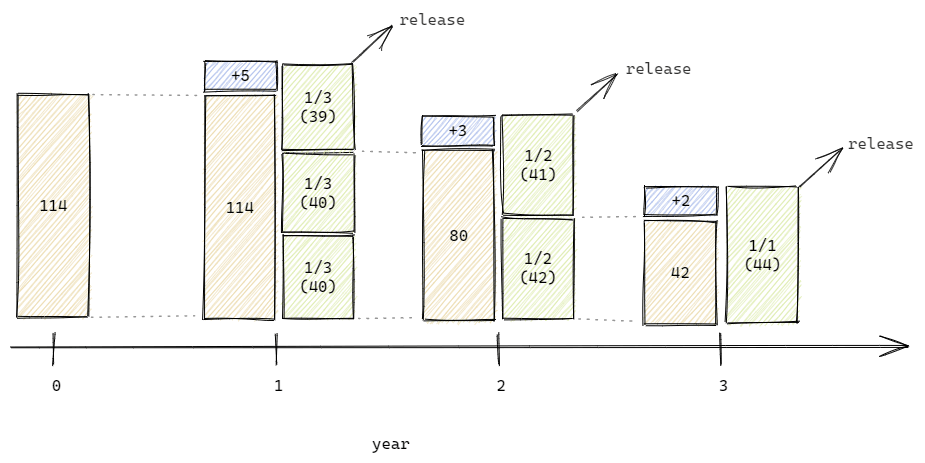

We now know how the CSM will change after a year. Let's see the changes over the whole coverage period. In our example it's 3 years.

We start with CSM of €105. After a year, the accretion is 3% * €105 ≈ €3. Together we have €108. We have provided service for a year, but we still have two years remaining. We can already release 1/3 of the CSM which is €36. That leaves us with €72.

After the second year, again we can recognize the accretion which amounts to 3% * €72 ≈ €2. We've got €74 of CSM. We have provided service for another year, but we still have one year left. So we can release 1/2 of €74 which is €37.

After the third year, if we allow for interest accretion, the CSM amounts to €38. The policy has ended, so we can release all the remaining CSM.