A positive CSM is released to the income statement over the coverage period.

What about groups of insurance contracts that are onerous, and therefore expected to be loss-making?

In this post, we will consider three cases:

- Contracts with reduced CSM

- Initially onerous contracts

- Contracts that become onerous

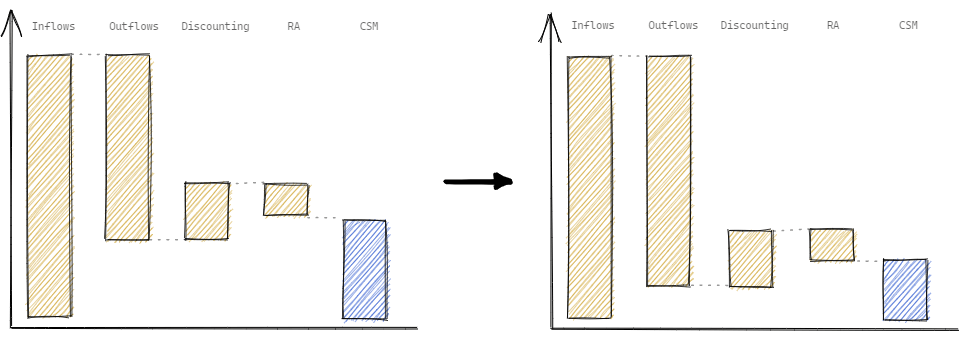

Contracts with reduced CSM

The group of contracts might have a positive CSM at inception. It means that the insurer expected to make a profit on them.

Over time, there might be changes in non-financial assumptions. Let's assume that changes in non-financial assumptions have a negative impact on the CSM, but it remains positive. The insurer still expects a profit, but it will be lower than initially hoped for.

In that situation, we should adjust the CSM to take into account the reduced profitability.

Initially onerous contracts

There might be groups of contracts where the insurer expects to make a loss from the beginning. For example, the insurer launches a new product and prices it to gain market share from a competitor.

If the group of contracts is onerous at inception, IFRS 17 requires these contracts to be allocated to a separate group that does not include contracts with a positive CSM.

For this group of contracts, no CSM is established. Instead, the initial measurement of the net fulfilment cash flows is recognised as a loss in the statement of profit or loss.

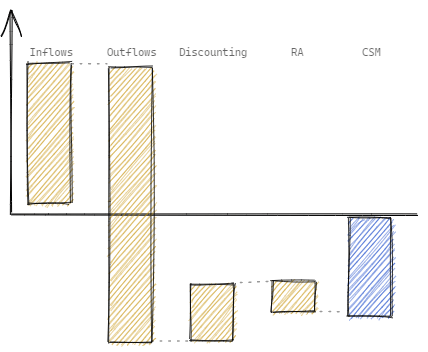

Contracts that become onerous

Some groups of contracts can become onerous after inception. This can be due to a material negative impact from changes in non-financial assumptions.

In this case, the excess amount is immediately recognised in the income statement.

Once a group of contracts becomes onerous, all subsequent positive changes in non-financial assumptions are booked in the income statement as a reversal of previously recognised losses.

If the impact of a positive change in assumptions is larger than the cumulative loss booked in the income statement, the excess is used to re-establish a CSM.

(2025-02-28)

Those are nice pictures. Thanks for sharing!