AI chatbots, such as ChatGPT, are shaping the way we work. Personally, I find them useful, especially for refreshing my memory on programming syntax.

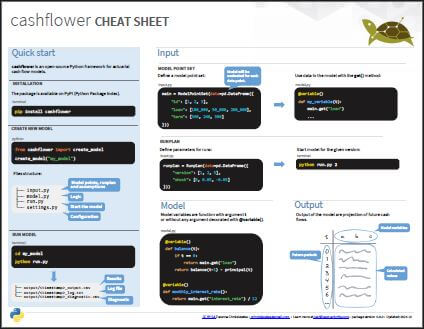

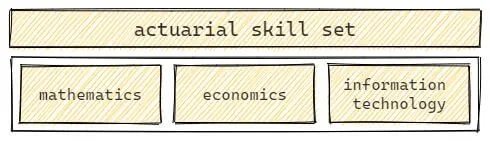

Given that cashflower is an open-source package with documentation available online, I decided to explore if an AI assistant can be used to help with actuarial …