Interest rates play a vital role in actuarial cash flow models by helping us figure out the value of money over time. In this blog post, we'll show you how to use interest rates in a Python cash flow model with a practical example.

Forward and spot rates

Interest rates curve

Often, when we first learn about the time value of cash flows, we're introduced to a single interest rate, like \( i=0.04 \) yearly. We say that \( 100 \) euros is worth \( 100 \cdot 1,04 = 104 \) euros in a year, \( 104 \cdot 1,04 = 108,16 \) in two years and so on.

However, in actuarial practice, we use interest rate curve rather than a single interest rate. Using interest rate curve means that we expect a different interest rate in each period.

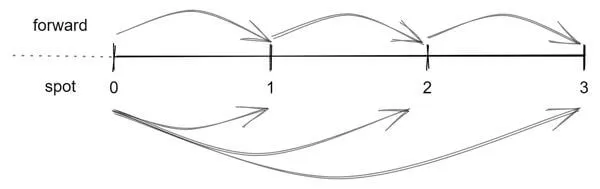

Interest rates can be represented in two primary ways: as forward rates and as spot rates. Forward rates denote the anticipated change in value between two future moments, while spot rates illustrate the expected change in value for a specific maturity.

Calculation example

Let's take a practical example. Here are the rates for the next three periods:

| period | forward | spot |

|---|---|---|

| \( 1 \) | \( 0.020000 \) | \( 0.020000 \) |

| \( 2 \) | \( 0.025000 \) | \( 0.022497 \) |

| \( 3 \) | \( 0.030000 \) | \( 0.024992 \) |

For this example, let's start with 100 euros.

First period

The value of that 100 euros after the first period is calculated in the same way using forward and spot rates.

Forward: \( 100 \cdot (1 + 0.02) = 102 \)Spot: \( 100 \cdot (1 + 0.02) = 102 \)

After the first period, we will have 102 euros.

Second period

We reinvest all the money, and after the second period, we have:

Forward: \( 100 \cdot (1 + 0.02) \cdot (1 + 0.025) = 104.55 \)Spot: \( 100 \cdot (1 + 0,022497)^2 = 104.55 \)

We now have 4.55 euros more than we started with.

Third period

Once again, we reinvest, and after the third period, we receive:

Forward: \( 100 \cdot (1 + 0.02) \cdot (1 + 0.025) \cdot (1 + 0.03) = 107.69 \)Spot: \( 100 \cdot (1 + 0.024992)^3 = 107.69 \)

At the end, we have 107.69 euros.

To calculate the time value of money using forward rates, we use all rates from the curve up to the given period. To calculate the time value of money with spot rates, we use only the rate for the given period.

Mathematical formula

We can use the following formula to calculate the future value ( \( FV \) ) of 1 euro after \( n \) periods using forward and spot rates:

Forward: \( FV_{n} = (1+f_{1}) \cdot (1+f_{2}) \cdot … \cdot (1+f_{n}) \)

Spot: \( FV_{n} = (1 + s_{n})^n \)

The formula for the forward rate in the period \( n \):

\( f_{n} = \frac{ (1+s_{n})^t }{ (1+f_{1}) \cdot (1+f_{2}) \cdot ... \cdot (1 + f_{n-1}) - 1} = \frac{ (1+s_{n})^t }{ (1+s_{n-1})^{t-1} - 1 }\)

If the rate are annual, then use the following formula to get monthly rates:

\( (1+f_{t})^{1/12}-1 \)

Modelling

Let's explore how to use interest rates curve in practice. For this, we'll leverage the cashflower package in Python.

Preparation

If you haven't already, please install the cashflower package using your terminal:

pip install cashflowerNext, let's create a dedicated model called interest_rates using Python:

from cashflower import create_model

create_model("interest_rates")The create_model() function sets up the necessary file structure for our model:

interest_rates/

input.py

model.py

run.py

settings.py

Input

We will use the risk-free interest rates published by EIOPA. You can find the relevant file in the "Monthly Technical Information" section. For this tutorial, we have already prepared the data in the form of a csv file:

# input.py

import pandas as pd

assumption = {

"interest_rates": pd.read_csv("./input/interest_rates.csv", index_col="T")

}

Let's take a look at the data:

print(assumption["interest_rates"]) VALUE

T

1 0.00736

2 0.01266

3 0.01449

4 0.01610

5 0.01687

.. ...

146 0.03191

147 0.03192

148 0.03194

149 0.03196

150 0.03198

Two important points to note:

- The data spans the next 150 years, which is sufficiently long since cash flow models typically cover periods of up to 120 years.

- These rates are annual, but our cash flow model operates with monthly periods, so we'll need to convert annual rates into monthly ones.

Model

Now, let's set up the core components of our financial model.

Projection year

We need to define a projection year to read the corresponding interest rate.

# model.py

@variable()

def projection_year(t):

if t == 0:

return 0

elif t % 12 == 1:

return projection_year(t-1) + 1

else:

return projection_year(t-1)

The projection year starts at zero and increments by one at the beginning of each year.

Yearly spot rate

We can now read the yearly spot rates from our assumption table using the projection year:

# model.py

@variable()

def yearly_spot_rate(t):

if t == 0:

return 0

else:

return assumption["interest_rates"].loc[projection_year(t)]["VALUE"]

For example, the interest rate for the first year is 0.736%, indicating that €100 will be worth €100.74 after a year.

Yearly forward rate

The yearly forward rate is calculated based on the yearly spot rates.

# model.py

@variable()

def yearly_forward_rate(t):

if t == 0:

return 0

elif t == 1:

return yearly_spot_rate(t)

elif t % 12 != 1:

return yearly_forward_rate(t-1)

else:

return ((1 + yearly_spot_rate(t))**projection_year(t)) / ((1 + yearly_spot_rate(t-1))**projection_year(t-1)) - 1Monthly forward rate

Since our model operates on a monthly basis, we also need to calculate the monthly forward rate. This is done as follows:

# model.py

@variable()

def forward_rate(t):

return (1+yearly_forward_rate(t))**(1/12)-1

Discount rate

To calculate the present value of future cash flows, we need discount rates. In our cash flow models, we use discount rates that apply for one period at a time:

# model.py

@variable()

def discount_rate(t):

return 1/(1+forward_rate(t))

This formula calculates the discount rate for each period, allowing us to determine the present value of cash flows.

Cash flows

Now that we have our model structure in place, let's create and calculate the values for two payment streams, payment1 and payment2.

# model.py

@variable()

def payment1(t):

if t == 0:

return 100

else:

return 0

@variable()

def payment2(t):

if t == 24:

return 250

else:

return 0

@variable()

def future_value_payment1(t):

if t == 0:

return payment1(t)

return payment1(t) + future_value_payment1(t-1) * (1+forward_rate(t))

@variable()

def present_value_payment2(t):

if t == settings["T_MAX_CALCULATION"]:

return payment2(t)

return payment2(t) + present_value_payment2(t+1) * discount_rate(t+1)

These variables represent two payment streams. The first payment is a payment of €100 at the beginning of the projection, while the second payment is a payment of €250 after 2 years (24 months). We've also calculated future and present values based on the interest rates and discount rates.

Results

To view the results of our calculations, source the run.py script.

# output

t projection_year yearly_spot_rate yearly_forward_rate forward_rate discount_rate payment1 payment2 future_value_payment1 present_value_payment2

0 0.0 0.00000 0.000000 0.000000 1.000000 100.0 0.0 100.000000 243.788209

1 1.0 0.00736 0.007360 0.000611 0.999389 0.0 0.0 100.061127 243.937231

2 1.0 0.00736 0.007360 0.000611 0.999389 0.0 0.0 100.122292 244.086343

3 1.0 0.00736 0.007360 0.000611 0.999389 0.0 0.0 100.183494 244.235547

4 1.0 0.00736 0.007360 0.000611 0.999389 0.0 0.0 100.244734 244.384842

5 1.0 0.00736 0.007360 0.000611 0.999389 0.0 0.0 100.306011 244.534228

6 1.0 0.00736 0.007360 0.000611 0.999389 0.0 0.0 100.367325 244.683705

7 1.0 0.00736 0.007360 0.000611 0.999389 0.0 0.0 100.428677 244.833274

8 1.0 0.00736 0.007360 0.000611 0.999389 0.0 0.0 100.490067 244.982934

9 1.0 0.00736 0.007360 0.000611 0.999389 0.0 0.0 100.551494 245.132686

10 1.0 0.00736 0.007360 0.000611 0.999389 0.0 0.0 100.612958 245.282529

11 1.0 0.00736 0.007360 0.000611 0.999389 0.0 0.0 100.674460 245.432464

12 1.0 0.00736 0.007360 0.000611 0.999389 0.0 0.0 100.736000 245.582490

13 2.0 0.01266 0.017988 0.001487 0.998515 0.0 0.0 100.885771 245.947616

14 2.0 0.01266 0.017988 0.001487 0.998515 0.0 0.0 101.035766 246.313284

15 2.0 0.01266 0.017988 0.001487 0.998515 0.0 0.0 101.185983 246.679496

16 2.0 0.01266 0.017988 0.001487 0.998515 0.0 0.0 101.336423 247.046252

17 2.0 0.01266 0.017988 0.001487 0.998515 0.0 0.0 101.487088 247.413553

18 2.0 0.01266 0.017988 0.001487 0.998515 0.0 0.0 101.637976 247.781401

19 2.0 0.01266 0.017988 0.001487 0.998515 0.0 0.0 101.789088 248.149795

20 2.0 0.01266 0.017988 0.001487 0.998515 0.0 0.0 101.940425 248.518738

21 2.0 0.01266 0.017988 0.001487 0.998515 0.0 0.0 102.091988 248.888228

22 2.0 0.01266 0.017988 0.001487 0.998515 0.0 0.0 102.243775 249.258268

23 2.0 0.01266 0.017988 0.001487 0.998515 0.0 0.0 102.395788 249.628859

24 2.0 0.01266 0.017988 0.001487 0.998515 0.0 250.0 102.548028 250.000000

25 3.0 0.01449 0.018160 0.001501 0.998501 0.0 0.0 102.701939 0.000000

Now it's finally time to take a look at the results.

Few things to note:

- projection year - it increases by 1 every 12 months,

- yearly spot rate - we read values from assumptions; these are yearly rates so there is the same value for the consecutive 12 months,

- yearly forward rate - it has the same value for the first year as yearly spot rate and changes afterwards,

- forward rate - it's a monthly rate, it has the same value for each projection year,

- discount rate - similar to forward rate, it's a monthly rate with the same value for each projection year,

- future_value_payment1 - value of the payment1 increases each month; the value for t=24 could be calculated also as 100 * (1+yearly_spot_rate(t=24))**2,

- present_value_payment2 - the payment hasn't happened yet, it will happen at t=24 but we can calculate what this money is worth for us now at t=0.

Thanks for reading this tutorial! I hope it was helpful. Feel free to leave a comment below or on github with any questions or thoughts. Your feedback matters. Happy learning!