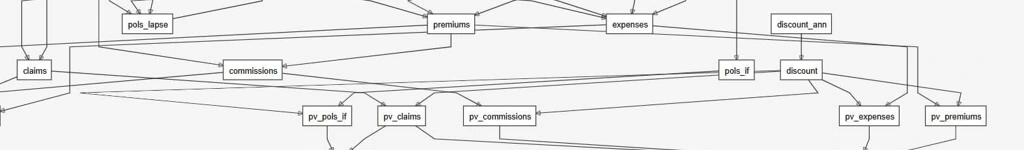

Actuarial cash flow models can quickly become complex, with dozens of interdependent variables. When that happens, it's easy to get lost in the code. That's where Graph View, a new feature in the cashflower Python package, comes in.

Graph View lets you visualize your entire model, making it …